Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!

Arpita Sinha, Co-founder & CBO of Cashvisory, for being named “Woman Leader of the Year” at the BW Disrupt Festival of Fintech 2025! Category : Blog A proud moment for Cashvisory! 🏆 Co-founder & Chief Business Officer, Arpita Sinha, has been honoured as the “Woman Leader of the Year” at the prestigious BW Disrupt Festival of Fintech 2025! 🎉 Selected under the Hallmark category, this award celebrates Arpita’s bold vision and unwavering commitment to making finance accessible, transparent, and empowering, especially for young India. As if that wasn’t enough,She also took the stage at the She Builds Bharat panel alongside leading women founders to discuss gaps in financial literacy and the urgent call for action to bridge them. We’re beyond proud. Arpita’s leadership is not just building a company, it’s setting a new benchmark for what inclusive fintech should look like. 📖 Read the feature:🔗 https://lnkd.in/gUrdCzi4🏆 https://lnkd.in/d2i2_cxH SucSEED Ventures, We Founder Circle, EvolveX Accelerator, BeyondSeed, Razorpay Rize hashtag#Cashvisory hashtag#WomanLeaderOfTheYear hashtag#BWBestOfFintech hashtag#WomenInFintech hashtag#Leadership hashtag#FinancialLiteracy hashtag#StartupIndia hashtag#FintechIndia hashtag#Womenfounder Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, for being named “Woman Leader of the Year” at the BW Disrupt Festival of Fintech 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

OLL has successfully given our investors an exit with a 1800% ROI in 3 years

OLL has successfully given our investors an exit with a 1800% ROI in 3 years Category : Blog From a vision to empower every student with practical skills to building a nationwide movement, this journey was never just about business — it was about belief. Thank you to every investor who backed us when i was just a 17 year old kid with a big dream Thank you : Monica Gupta ( for listening to my pitch and recommending me to Evolve X and getting Earlyseed ventures too) Bhawna B. ( the first person to accept me in Evolve X cohort)We founder circleNeeraj Tyagi , Gaurav VK Singhvi (always pushing me to do better) Sandeep Balaji ( for getting his family and friends along too and being the biggest support along the way) Sreekumar Brahmanandan , Deepesh Hinduja , Mili Srivastava Earlyseed Ventures :Manan Patel , Rahul Hingmire , Aniket Shivaji Wagh Angel investors :Harsh Mehta , Vikas Gambhir , Dr Milan Modi , Tarun Billa You believed in the mission. Today, that belief has compounded. Nothing makes me more happy than providing Value to the ones who believed in me. Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!

EVOLVEX COHORT 5 : A RESOUNDING SUCCESS! Category : Blog What an incredible two days it has been at EvolveX Cohort 5! We’re still buzzing from the energy, insights, and connections that filled The Amore Hotel, Surat on 7th & 8th March 2025 Highlights from the Event:✅ Fundraising Fundamentals that equipped founders with the tools to secure their next round. Session by Gaurav VK Singhvi (Avinya VC) – a masterclass in visionary leadership.✅ Goal Setting & Leadership by Anand Naidu✅ Lean Growth Strategies by Mukul Goyal (StratefiX Consulting) – actionable insights to scale smarter.✅ Legal Compliance by Ritu Soni (Chir Amrit Legal) – simplifying the complexities of startup law.✅ Sales Metrics by Vikas Aggarwal Aggarwal (We Founder Circle) – decoding the numbers that matter.✅ Why Businesses Fail? by Neeraj Tyagi (We Founder Circle) – a deep dive into avoiding common pitfalls. The event was more than just sessions – it was about building a community of passionate founders, sharing stories, and creating lifelong connections. A heartfelt thank you to:✨ Our speakers for sharing their wisdom and expertise.✨ Our partners – Invstt, We Founder Circle and Avinya Ventures – for their unwavering support.✨ And most importantly, YOU – the founders, dreamers, and doers who made this event unforgettable. Stay tuned for event photos and key takeaways – we’ll be sharing them soon! Here’s to the future of innovation and entrepreneurship. Until next time, keep evolving! 🚀 Participating Startups: Ivana Jewels by Jindal | SCANDALous Foods (ADITOF) | PrepAud | SETV global | Ugees | Pickkup.io | SHAKTI WEARABLES | Testntrack | & More hashtag#EvolveX hashtag#Cohort5 hashtag#StartupSuccess hashtag#Entrepreneurship hashtag#Networking hashtag#Leadership hashtag#Fundraising hashtag#WeFounderCircle hashtag#AvinyaVentures hashtag#SuratEvents Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

Celebrating the Powerhouse Women of EvolveX!

Celebrating the Powerhouse Women of EvolveX! Category : EvolveX Updates,Portfolio Update At EvolveX Accelerator, we believe that innovation knows no boundaries, and success is shaped by the visionaries who dare to dream big. Today, we take a moment to celebrate the incredible women leaders in the EvolveX family who are redefining industries, breaking barriers, and inspiring the next generation of entrepreneurs. From healthtech and fintech to D2C brands and AI-driven platforms, these powerhouse women are leading the charge, turning challenges into opportunities, and leaving an indelible mark on the startup ecosystem. Their resilience, leadership, and unwavering dedication remind us why diversity in entrepreneurship is essential for driving meaningful change. Meet the Trailblazing Women of EvolveX: 🌟 Meghana Dave – HealthQrehabEmpowering individuals with cutting-edge rehabilitation solutions to improve mobility and recovery. 🌟 Ayushi Jindal – Ivana Jewels by JindalBringing luxury and sustainability together with lab-grown diamond jewelry for the modern consumer. 🌟 Arpita Sinha – CashvisoryRevolutionizing financial advisory with AI-driven insights to help individuals make smarter investment decisions. 🌟 Shivani Thakur – PrepAudTransforming government job exam preparation with AI-powered audio notes and mock test platforms. 🌟 Dr. Srishti Sharma – Shakti WearablesCreating innovative, non-lethal personal safety devices to empower women and enhance security. 🌟 Upma Sharma – Pickkup.ioRedefining B2B EV logistics with sustainable, last-mile delivery solutions. 🌟 Aditi Balbir & Shruti Anand – EcoRatingsPioneering sustainability in the consumer sector with a data-driven approach to eco-friendly products. Honoring Their Impact Your contributions, passion, and relentless pursuit of excellence inspire us all. Whether through groundbreaking technology, sustainable solutions, or empowering communities, each of you plays a vital role in shaping the future. We are immensely proud to have you as part of the EvolveX family and look forward to celebrating your continued successes. May your journeys be filled with innovation, impact, and new milestones! 💙 Join Us in Celebrating Women in Leadership! Tag and share your appreciation for the women entrepreneurs making a difference. Let’s amplify their achievements and encourage more women to step into leadership roles! #EvolveX #WomenInLeadership #StartupFounders #Gratitude #Innovation Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

EvolveX Accelerator Welcomes Cohort 5: 7 High-Potential Startups Ready to Scale!

EvolveX Accelerator Welcomes Cohort 5: 7 High-Potential Startups Ready to Scale! Category : EvolveX Updates The startup ecosystem thrives on innovation, resilience, and strategic growth, and at EvolveX Accelerator, we are committed to nurturing early-stage startups with the capital, mentorship, and network they need to succeed. With the successful completion of Cohort 5, we are thrilled to introduce the 7 high-potential startups that have joined the EvolveX family. These companies are solving critical industry challenges across AI, SaaS, D2C, logistics, and healthcare, and we can’t wait to see their journey unfold. Meet the 7 Startups in EvolveX Cohort 5 1. PickkUp (B2B EV Logistics | Mohali, Punjab)🔹 Revolutionizing last-mile and mid-mile logistics with an electric fleet of 3W & 4W commercial vehicles, making sustainable transportation more accessible for businesses.👥 Founders: Ankush Sharma, Chandra Shekhar, Upma Sharma 2. PrepAud (AI in Edtech | Gurugram, Haryana)🔹 An AI-driven audio notes and mock test platform, helping government job aspirants prepare on the go with a personalized, mobile-first experience.👥 Founders: Diwakar Prasad, Shivani Thakur, Vishwakant Bhardwaj 3. MessageMe (B2B SaaS | Pune, Maharashtra)🔹 Developing an enterprise messaging platform to streamline external communication for businesses, improving customer engagement and efficiency.👥 Founder: Kanak Kawadiwale 4. SETV (AI in Healthcare | Bengaluru, Karnataka)🔹 AI-powered software designed to enhance diagnostics for radiologists, pathologists, and doctors, enabling faster and more accurate medical assessments.👥 Founder: Vaibhav Ram 5. Ivana Jewels (D2C | Surat, Gujarat)🔹 A lab-grown diamond jewelry brand, redefining luxury with sustainable, high-quality designs for modern consumers.👥 Founders: Yogit Jindal, Ayushi Jindal 6. BlackCarrot (D2C | Mumbai, Maharashtra)🔹 India’s first health-conscious dinnerware brand, offering lead-free, high-quality ceramic tableware designed for contemporary lifestyles.👥 Founders: Neha Dhupia, Vishal Gupta, Yadupati Gupta 7. Shakti Wearables (D2C | Gurugram, Haryana)🔹 Innovating a smart wearable safety device to help women protect themselves from physical threats, ensuring peace of mind in public spaces.👥 Founder: Shristi Sharma What’s Next for Cohort 5? Over the next few months, these startups will receive: ✅ $30,000 – $40,000 in upfront funding ✅ Strategic mentorship from seasoned entrepreneurs and investors ✅ Access to EvolveX’s vast network of angel investors, VCs, and industry experts ✅ Guidance on refining product offerings, business strategies, and market expansion Our goal is to equip them with the right resources and connections to scale faster, attract investors, and build sustainable, high-impact businesses. Industry Leaders on EvolveX Cohort 5 💬 Vikas Aggarwal, Co-Founder, We Founder Circle & Partner, Avinya VC, shares:“EvolveX Accelerator is back, continuing our commitment to investing in early-stage startups. With the successful completion of Cohort 5, we are excited to launch applications for Cohort 6 and look forward to supporting more visionary founders.” 💬 Neeraj Tyagi, Co-Founder, We Founder Circle & Partner, Avinya VC, adds:“Congratulations to all the amazing founders in Cohort 5! This batch is a great mix of enthusiasm and maturity, and they are already building fundamentally strong businesses. We can’t wait to see them evolve into high-impact ventures.” Applications for Cohort 6 Now Open! With five successful cohorts and 35+ startups supported, EvolveX continues to be a launchpad for early-stage entrepreneurs. If you are a startup founder looking for funding, mentorship, and investor access, Cohort 6 applications are now open! 🚀 Apply Now: [EvolveX Cohort 6] Stay tuned as we track the progress of Cohort 5 startups and celebrate their milestones! Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

EvolveX Fuels BlackCarrot’s Growth with Strategic Seed Investment

We believe that BlackCarrot has the potential to become a household name in India and beyond. We’re excited to be part of their journey and contribute to their success.

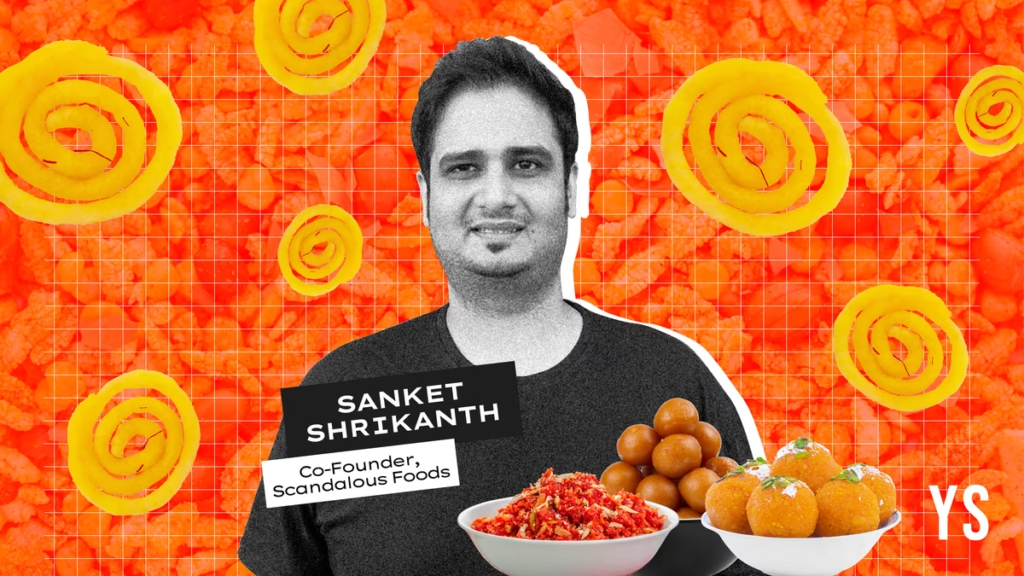

Scandalous Foods closes pre-seed round

Scandalous Foods closes pre-seed round Category : Portfolio Update B2B sweets startup Scandalous Foods has announced the completion of its pre-seed funding round at Rs 3 crore. The most recent infusion of Rs 1.4 crore came from the Indian Angel Network (IAN), spearheaded by KRS Jamwal and Mrunal Jhaveri and notable angel investors Arjun Vaidya of V3 Ventures, Ajay Mariwala, MD of VKL and FSIPL, and Sushma Gupta. Scandalous Foods raised 1.6 crore in the first tranche of the pre-seed funding round in December last year. The funds will be utilised to establish a larger production facility and expansion, Scandalous Foods said in a press release. The firm now looks to broaden its footprint across the food service industry and build a robust HoReCa base in key markets, including Mumbai and Nasik. “With the additional Rs 1.4 crore, we are better equipped than ever to innovate, expand, and cater to the growing demands of our diverse clientele. Our journey from a nascent startup to a trailblazer in the industry has been exhilarating, and this is just the beginning,” said Sanket S, founder of Scandalous Foods. Co-founded in August 2022, Scandalous Foods is a business-to-business company that empowers the sweets industry for the restaurant sector. It offers preservative-free sweets with a 6-month shelf life. The company operates with a focus on cloud kitchens and plans to expand to various food service segments. Currently, a B2B company with aspirations for B2B2C and B2C expansion, Scandalous Foods is set to introduce mithai bars and sachets shortly. Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

ParkMate raises $1.2 Mn

ParkMate raises $1.2 Mn Category : Portfolio Update Car parking solutions provider ParkMate has raised $1.2 million in a new round led by early growth-stage venture fund Cactus Partners. Existing backers such as Venture Catalysts and the Marwah Group Family Office have also participated in the round. According to ParkMate, the funds will be used to ramp up its growth trajectory, invest in its team to win business, streamline its operations, and continue to innovate new solutions. Co-founded by Abhimanyu Singh and Dhananjaya Bharadwaj, ParkMate offers smart parking solutions to shopping malls, office complexes, and Hotels in the corporate segment and to parking contractors for government parking spaces. The firm’s exclusive DaSH (Drop & Shop) service claims parking within 2 minutes for car owners at shopping malls, arcades, and business complexes. It counts as DLF, Phoenix Mills, Fun Republic, the UP, and Telangana Governments. Smart cities are another sizeable market for ParkMate. It directly competes with Park+, Get My Parking, Park Smart, and Parky, among others. Park+ is the largest player in this segment. In June, the company ventured into the on-demand driver services segment with Drive+, positioning it as a potential competitor to DriveU, Drivers4Me, Driverzz, PickMyCar, Namma Driver, and Cars24. This marks the eighth investment by Cactus Partners since January 2021. The firm has invested in companies such as Lohum Cleantech, Kapture CX, Vitraya Technologies, AMPM Fashions, Auric, Indigrid Technology, and Rubix Data Sciences (exited). Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

Plus Gold Strikes 400% MoM Growth

Plus Gold Strikes 400% MoM Growth Category : Blog India’s affinity for gold jewellery has been well-known for ages. However, the recent spike in gold prices reduced the country’s consumption to 562.2 tonnes in 2023, a 6.39% dip from 600.6 tonnes of gold as jewellery in 2022, according to the World Gold Council. On the other hand, China raced to the top last year, consuming 630.2 tonnes of gold as jewellery. But away from the discretionary purchase of jewellery, this precious metal is rapidly gaining traction in India as an asset class. There has been an upsurge in the consumption of bullion (bars, coins and ingots) and investments in sovereign gold bonds (SGBs) since 2022. In fact, the December quarter (Q3 FY24) saw a record rise in SGB investments, reaching 12.1 tonnes at a little over INR 7.5K Cr. In contrast, investing through legacy banks/FIs can be cumbersome. It requires a lump sum down payment equivalent to the gold value, has stringent upper limits and long lock-in periods (a minimum of five years). Moreover, returns are pretty low, an annual interest rate of 2.5% in case of sovereign gold bonds issued by the RBI. Private jewellers offer EMI-based gold-buying schemes, but these also lack flexibility. One can only buy from a specific jeweller instead of browsing through a varied marketplace and may have to pay exorbitant prices. Also, missing a single EMI may lead to the forfeiture of the benefits accrued. According to investment professionals, a high-value commodity like gold needs staggered buying to avoid short-term volatility. Gold gains can only boom when buyers have the much-needed flexibility to choose their timing and price. Otherwise, it will invariably turn into a lead weight in one’s portfolio. Plus Gold and its ilk are offering small-time gold investors that rare opportunity to choose their product, price and pace. Hence, it should be a win-win for the gold savings fintech, its users and jeweller partners in the long run. Hot News Arpita Sinha, Co-founder & CBO of Cashvisory, wins “Woman Leader of the Year” at BW Disrupt Fintech Festival 2025!July 23, 2025 OLL has successfully given our investors an exit with a 1800% ROI in 3 yearsMay 21, 2025 EVOLVEX COHORT 5 : A RESOUNDING SUCCESS!March 10, 2025 Applications for Cohort 8 are Open We are a cohort-based startup accelerator program Learn More

EvolveX Backs EcoRatings: Empowering Consumers with Data-Driven Sustainability Assessments

EcoRatings, founded by a team of experienced professionals with backgrounds in impact assessment, technology, and business development, provides numerical sustainability ratings based on the United Nations’ 17 Sustainable Goals Framework.